Testing the waters

Remodeling your home is akin to getting into the water when the temperature is unknown. Most folks are timid and rightfully so.

I once found a full safe buried in the crawl space of a home I own. Although possible to repeat, and worth dreaming about…you must admit, the odds are not in your favor. Starting with enough funds to complete the project plus a 10% buffer for the unknown is a good plan A. Crossed fingers is not a good plan B. The traditional approach is to determine how much money you qualify for before you decide your remodeling priority list is. I think this approach is outdated and restricts the creative process. A better plan in my opinion is to create a comprehensive list of goals. Then create a set of plans and specifications with your contractor. Next have a bid created of what it will cost to accomplish. With plans and specifications in hand seek out your best funding options. This is the model that most design build firms use.

What are your goals?

Consider your long range goals. My belief is that there may be an opportunity now to do the entire project and be done with it. Living in a partially remodeled home until you can afford to finish is possible, I’ve seen it done. One recent example is a project where Levco managed to double the value of my client’s investment. I know this because he had the home appraised as is, then post project. By creating a great plan they were able to secure the funding to accomplished all of their ten year interior wish list at the same time.

Where are the funds man?

For years, escalating home values made acquiring funding a snap. Now that things have changed and values are down and money is tight it takes a creative path to find the financing you need. There are still sources of funding that need to be explored because there is not one size fits all solution. There are many experts inn the field of lending, I am not one of them. I do have lots of personal experience borrowing and have been given some insights to owners experiences. Many new home builders have favorite lenders. I suppose I am open to it, but I do not know of any residential remodelers in Boise Idaho that have developed those relationships.

What does a great program look like?

A great program can be changed at any time so the best source today may be long gone tomorrow. My preference is born out of practicality and is more about how it works rather than who is offering the funds at the time. In some cases, payments may even decrease in the end. This can happen if the stars align just right. An example is, your scope is small but value is high,( like adding a master bedroom and bath) while your term increases and your interest rate drops.

There are still lots of ways to finance a project. Home equity loans and lines of credit, or 203K FHA loans, to name a few. The list goes on and on.

Key concepts to understand include, but are not limited to…

- knowing your loan-to-value ratio.

- Having a decent credit score.

- Finding a lending source that is anxious to build their residential loan portfolio.

- Levco is a funding source and is backed by local lending institutions to qualified clients

Banks may or may not be the best place to look. Credit Unions are worth looking into and are often anxious to help.

Don’t be tempted by the shiny apple, the best choice may not be the first one you come upon. Find a broker for instance, that is familiar with your borrowing options today. A good lender will guide you into the best product for your short and long range goals. Understand that finding funding is secondary to having a project that make sense. There are many contractors who are willing to hook you up with a predatory lender, resist the temptation. Siding and roofing contractors are notorious for luring folks in with low payments. Check the price. Your best option may be a local lending source. Call for more details. 208 947-7261

Financing idea

My two favorites

- favorite lending option #1 at the moment, is based upon a pre-project evaluation of the “as-is” home value. Then they look at your scope of work and plans to come up with an estimated end of project value. Lending is based upon your end value. This essentially gives you a second opinion that your project makes sense. Once approved,your mortgage payments are on hold during the project and payments are made directly to the contractor based upon hitting milestones. Once the project is complete the real appraisal is done and a full refinancing occurs with a one time closing.

- Favorite Option #2 is getting a short term loan through our referral program for up to 35K for our clients who might just need a bathroom or minor remodeling project.

Be sure this is what you want to do.

Do a gut check before you commit, make sure that your are confident in your plan. Only when you can find clarity that the investment you are making will pay off for years is it safe to proceed. Whatever your choice, do your due diligence. develop a trusting relationship with the folks that are going to remodel your home, and your lender. Never under estimate the value in a good nights sleep. It comes from having found the funds that will enable you to realize your home remodeling dreams.

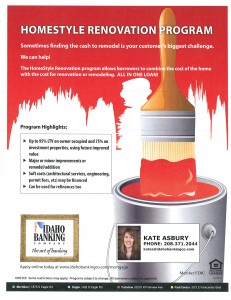

Great advice, Joe! I have a wonderful loan program that does just what you said, sets the loan off the “future-improved” value, so you don’t have to already have equity in your home. And it can be done on either a purchase or refinance!

Thanks Kate, I will post a link to your flyer